japan corporate tax rate history

Otherwise they are taxed at the corporate tax rate. The Australian National Minimum Wage is the minimum base rate of pay for ordinary hours worked to any employee who is not covered by a Modern Award or an Agreement.

Japan Tax Income Taxes In Japan Tax Foundation

The wages board did not set a universal minimum wage.

. Globalization or globalisation Commonwealth English. The term progressive refers to the way the tax rate progresses from low to high with the result that a taxpayers average tax rate is less than the persons marginal tax rate. Globalization has accelerated since the 18th century due to advances in transportation and communications technologyThis increase in global interactions has caused a growth in.

Meanwhile imports went down by 29 to 3299 billion as a decline in imports of consumer. Federal Corporate Tax Revenue and All Federal Tax Collections Headed for Another Record High. The following income chapter 3 status and Limitation on benefits LOB codes were added to Form 1042-S.

See spelling differences is the process of interaction and integration among people companies and governments worldwide. Total exports were up 02 to a new all-time high of 2593 billion as a rise in exports of services offset a decline in goods shipments. The tax is levied by the governing authority of the jurisdiction in which the property is located.

The global minimum corporate tax rate or simply the global minimum tax abbreviated GMCT or GMCTR is a minimum rate of tax on corporate income internationally agreed upon and accepted by individual jurisdictions. Each country would be eligible to a share of revenue generated by the tax. Bush passed the Troubled Asset Relief Program TARP authorized at 700 billion.

Not Your Fathers Catalog Music Streaming has made catalog music more important than ever - but the catalog thats growing isnt necessarily what youd expect. This page provides - Canada Corporate Tax Rate - actual values historical data forecast chart statistics economic calendar and news. An indirect tax such as sales tax per unit tax value added tax VAT or goods and services tax GST excise consumption tax tariff is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased.

Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. For example consider a system with three tax brackets 10 20 and 30. Corporate tax is imposed in the United States at the federal most state and some local levels on the income of entities treated for tax purposes as corporations.

Personal Income Tax Adjusts for Inflation But It Could Do Better. In case of tax brackets commonly used for progressive taxes the average tax rate increases as taxable income increases through tax brackets asymptoting to the top tax rate. Quantitative easing QE is a monetary policy whereby a central bank purchases predetermined amounts of government bonds or other financial assets eg municipal bonds corporate bonds stocks etc in order to inject money into the economy to expand economic activity.

Quantitative easing is an unconventional form of monetary policy which is usually used when inflation is. Our content on radio web mobile and through social media encourages conversation and the sharing of. New income code 56 was added to address section 871m transactions resulting from combining transactions under Regulations section 1871-15n including as modified by transition relief under Notice 2020-2.

In a proportional tax the tax rate is fixed and the average tax rate equals this tax rate. A property tax or millage rate is an ad valorem tax on the value of a property. The Corporate Tax Rate in Canada stands at 2650 percent.

At 35 the United States had the highest federal corporate income tax rate of any OECD country in 2012 and at 292 it had the OECDs fourth highest effective corporate tax rate in 2011 behind Germany Italy and Japan. McDonalds Corporation is an American-based multinational fast food chain founded in 1940 as a restaurant operated by Richard and Maurice McDonald in San Bernardino California United StatesThey rechristened their business as a hamburger stand and later turned the company into a franchise with the Golden Arches logo being introduced in 1953 at a location in Phoenix. In 1896 in Victoria Australia an amendment to the Factories Act provided for the creation of a wages board.

Find the latest sports news and articles on the NFL MLB NBA NHL NCAA college football NCAA college basketball and more at ABC News. Many countries impose such taxes at the national level and a similar tax may be imposed at state or local levels. Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937.

Corporate Tax Rate in Canada averaged 3757 percent from 1981 until 2020 reaching an all time high of 5090 percent in 1981 and a record low of 2610 percent in 2012. The aim is to reduce tax competition between countries and discourage. Since January 1 2018 the nominal federal corporate tax rate in the United States of America is a flat 21 due to the passage of the Tax Cuts and Jobs Act of 2017State and local taxes and rules vary by.

AOL latest headlines entertainment sports articles for business health and world news. A corporate tax also called corporation tax or company tax is a direct tax imposed on the income or capital of corporations or analogous legal entities. Changes to Form 1042-S.

In 2008 and 2009 the US Treasury and the Federal Reserve System bailed out numerous huge banks and insurance companies as well as General Motors and ChryslerCongress at the urgent request of US President George W. In Italy there is a tax of 26 on dividends known as capital gain tax. A progressive tax is a tax in which the tax rate increases as the taxable amount increases.

A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of. The trade deficit in the US narrowed by 102 billion to a 9-month low of 707 billion in July 2022 broadly in line with market forecasts of 703 billion. With a focus on Asia and the Pacific ABC Radio Australia offers an Australian perspective.

Progressive taxes are imposed in an. The bank sectors repaid the money by December 2009 and TARP. The increased normal rate of interest will apply to tax payments made after that date by companies that do fall within a quarterly instalment payment regime.

Rather it set basic wages for 6. Alternatively if the entity who pays taxes to the tax collecting authority. This section needs expansion.

The taxes may also be referred to as income tax or capital taxA countrys corporate tax may apply to. The term can be applied to individual taxes or to a tax system as a whole. Companies with a 31 December 2021 period end should settle their corporation tax liability not paid within a quarterly instalment payment regime by 1 October 2022.

In Japan there is a tax of 10 on dividends from listed stocks 7 for Nation 3 for Region while Jan 1st 2009 - Dec 31 2012 by tax reduction rule. This can be a national government a federated state a county or geographical region or a municipalityMultiple jurisdictions may tax the same property. Often a property tax is levied on real estate.

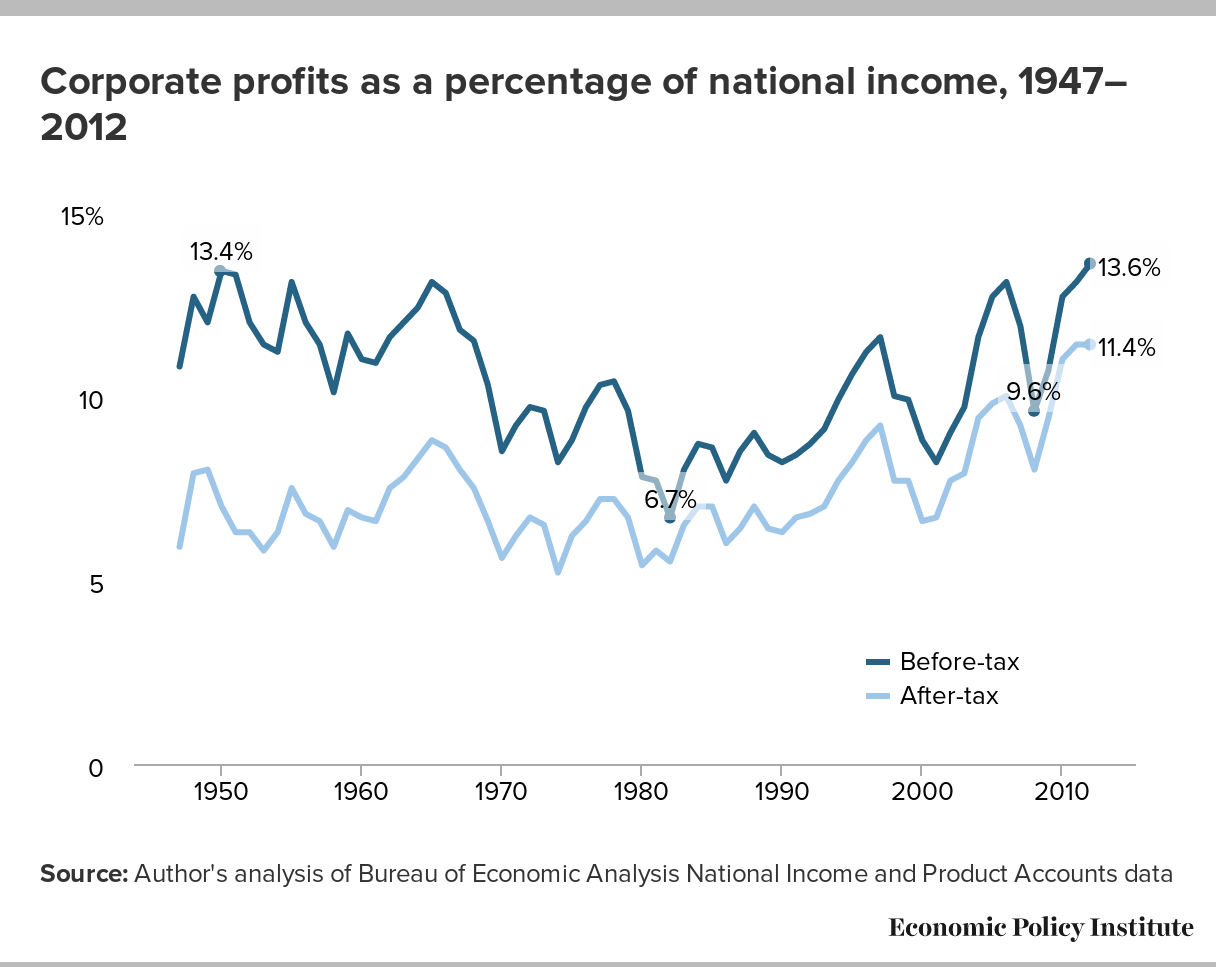

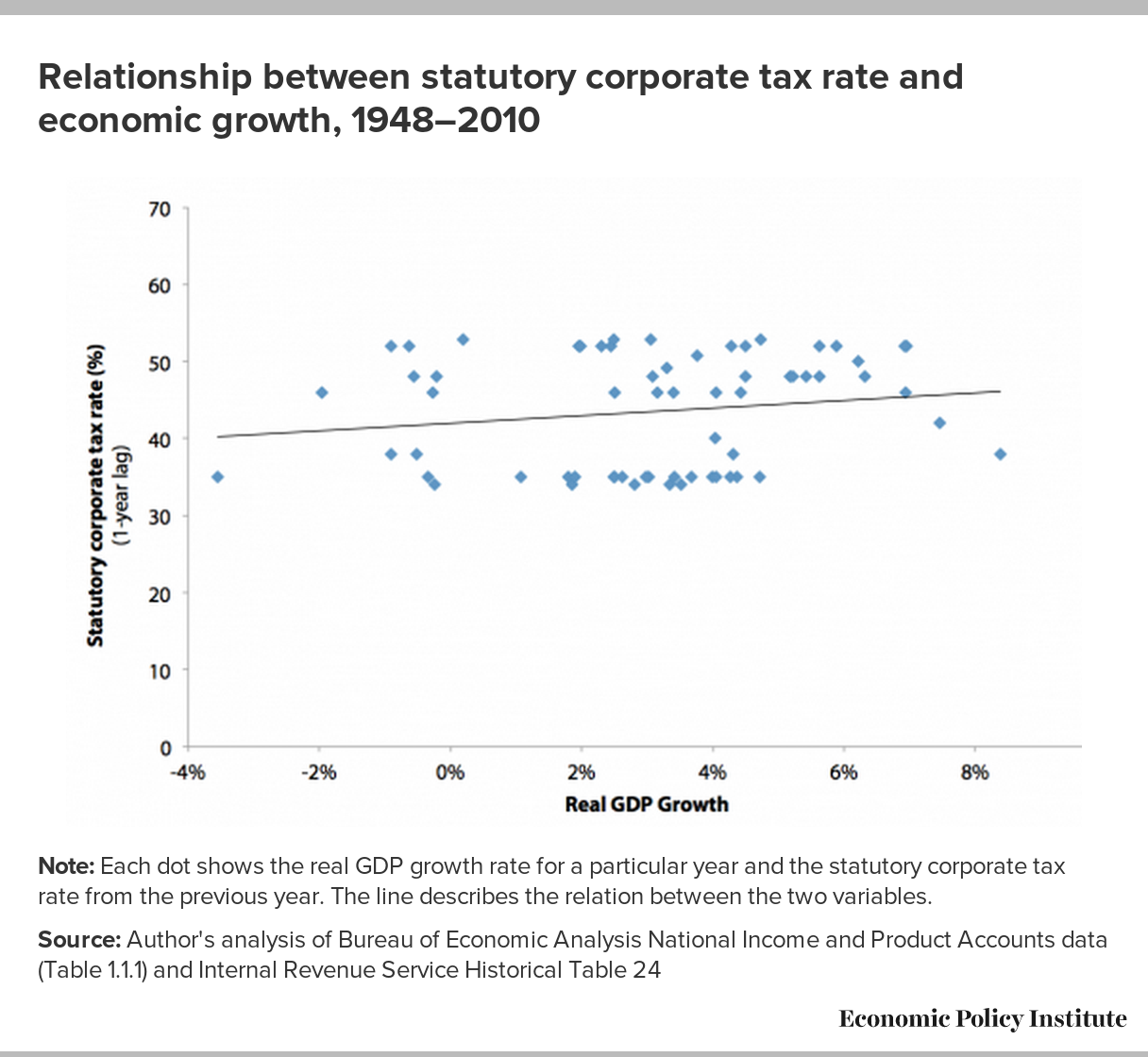

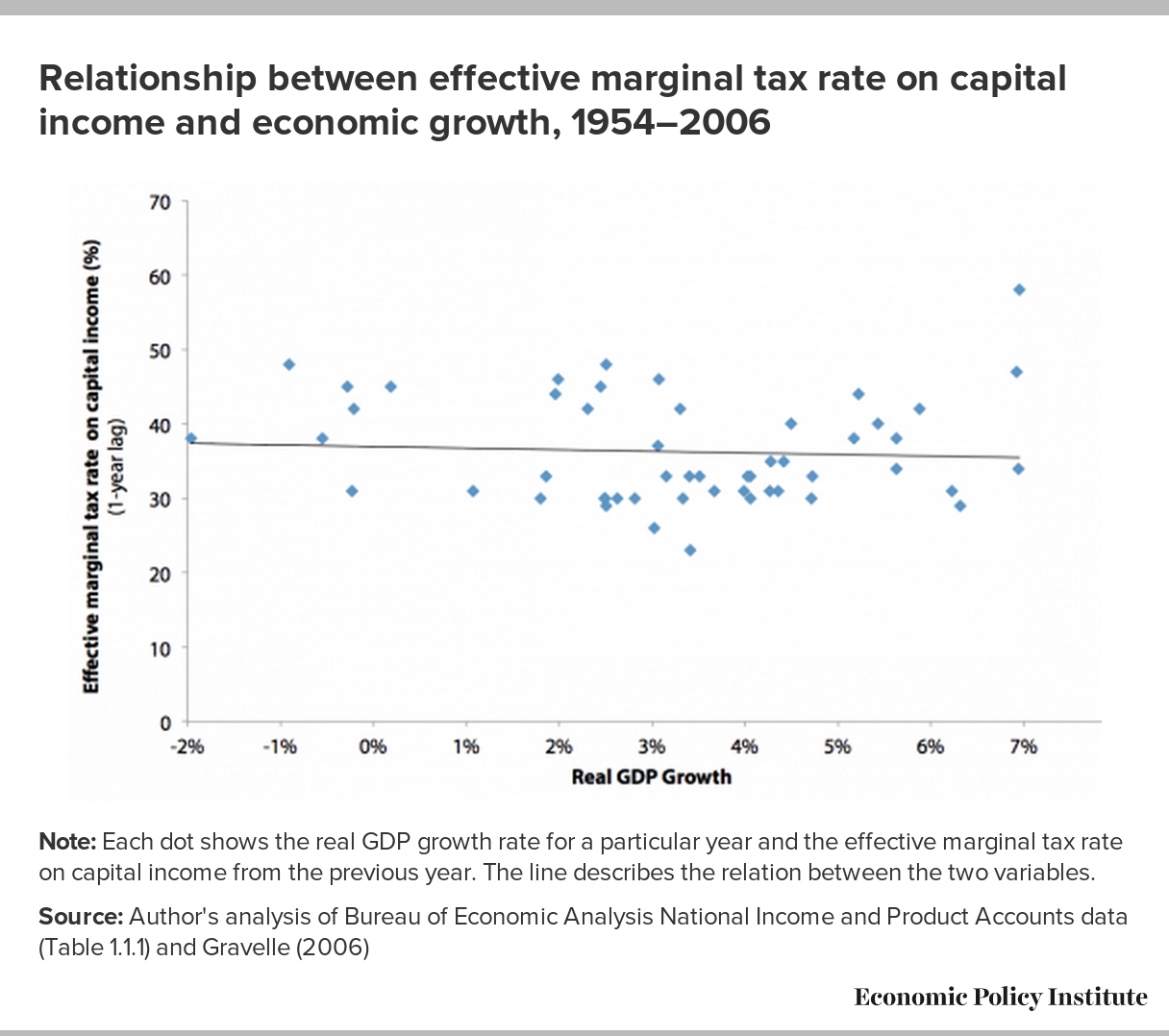

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Real Estate Related Taxes And Fees In Japan

Toward Meaningful Tax Reform In Japan Cato Institute

Micronesia Business Gross Revenue Tax August 2022 Data 2020 2021 Historical

Real Estate Related Taxes And Fees In Japan

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Malta Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

Toward Meaningful Tax Reform In Japan Cato Institute

Mexico Tax Rates Taxes In Mexico Tax Foundation

Real Estate Related Taxes And Fees In Japan

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Chile Tax Income Taxes In Chile Tax Foundation

Japanese Tax And Benefit System For Working Parents Marginal Tax Rates

Doing Business In The United States Federal Tax Issues Pwc